New GST Reforms Bring Relief and Savings for Indian Consumers

Good news for shoppers and small businesses! The Indian government has announced important changes to the GST (Goods and Services Tax) system that aim to make everyday items cheaper and boost the economy. These new reforms, approved during the recent GST Council meeting, are part of India’s effort to simplify taxes and help common people.

What’s Changing?

Under the new GST rules, the number of tax slabs has been reduced from four to just two main rates: 5% and 18%. There’s also a higher rate of 40% for luxury and harmful goods like tobacco and alcohol. This simplification makes it easier for consumers to understand and for businesses to comply, leading to a better tax system overall.

How Will It Help Ordinary People?

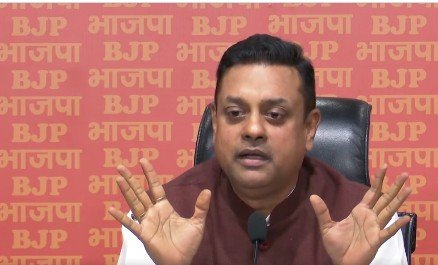

Finance Minister Nirmala Sitharaman announced that essential items like soap, shampoo, air conditioners, and small cars will now have a lower GST rate of 5% or 18%, making them more affordable. Basic food items such as milk, roti, paratha, and chenna will be GST-free, meaning no tax at all on these staples.

Health-related products are also benefiting: individual health and life insurance will now be tax-free, and 33 critical medicines, including those for rare diseases, will be exempt from GST. These changes make healthcare more accessible and affordable for everyone.

What Does This Mean for Daily Life?

Experts say this will lead to lower prices for many everyday goods. For example, groceries, fertilizers, footwear, and textiles will become cheaper. Items that previously had higher GST rates, like some vehicles and consumer electronics, will now cost less or be taxed at a more manageable rate.

The move to remove GST on health insurance is particularly important, as it helps more families afford quality healthcare. Overall, these reforms aim to put more money in the hands of consumers, which can give a boost to the economy.

What About Larger and Luxury Goods?

While essential items are getting cheaper, luxury products like high-end cars, tobacco, and alcohol will see a rise in GST to 40%, up from 28%. This is to discourage the consumption of harmful goods and to balance the tax system.

Big Impact for Small and Medium Businesses

Small traders and MSMEs (Micro, Small, and Medium Enterprises) are expected to benefit from a simpler tax structure. The reforms also address long-standing issues like the inverted duty structure, where raw materials were taxed more than finished products. Fixing this will help reduce production costs and support small industries.

The government hopes these changes will lead to more efficient tax collection and encourage compliance, which ultimately helps the economy grow stronger.

Overall, these GST reforms are designed to make daily essentials more affordable, support healthcare, and give a boost to small businesses and farmers. The new rates will come into effect from September 22, bringing relief to millions of Indians.