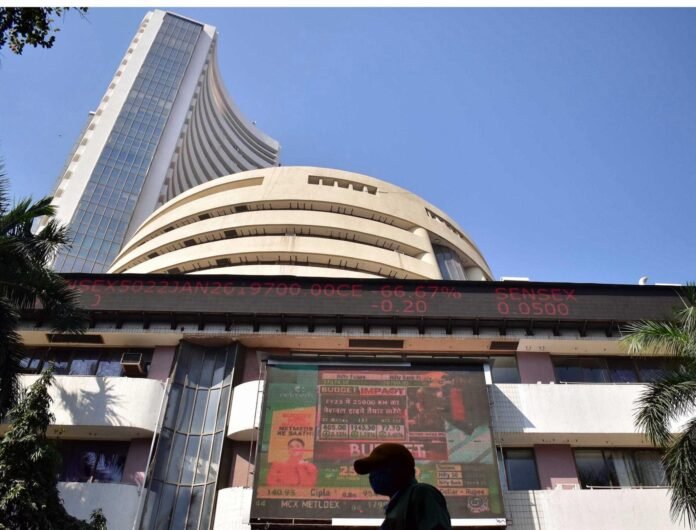

Indian stocks opened lower on Friday as traders reacted to two worries that rocked markets today. First, the United States looks set to start a fresh probe into China’s 2020 trade deal. Second, oil prices climbed after Washington slapped new sanctions on Russia, dampening investor mood.

At the first trade of the day, the Sensex slipped 113 points, down 0.13 % to 84,443. The Nifty fell 27 points, a 0.10 % drop, ending at 25,866.

Analysts said the Nifty still shows a sideways‑to‑bullish bias. It sits solidly above key support at 25,700–25,750. “If it can stay above 25,780 on closings, the trend stays positive,” they added. “Still, look for resistance around 25,950, with near‑term targets at 26,000 and 26,100.”

Major names that struggled included Hindustan Unilever, Kotak Bank, Axis Bank, Titan, Power Grid, ITC, NTPC, Tech Mahindra, Maruti Suzuki and Axis Bank, all falling more than 3 %. Winners this session were ICICI Bank, Tata Steel, Bharat Electronics, Mahindra & Mahindra, Bharti Airtel, HDFC Bank and State Bank of India, which helped curb overall losses.

The mid‑cap and small‑cap indexes held ground. The Nifty MidCap gained 0.05 %, and the Nifty SmallCap added 0.09 %. Metal stocks led the gains with the Nifty Metal index up 1 %, while Realty and Financial Services similarly edged higher. Fast‑moving FMCG stocks were the day’s biggest losers, with the Nifty FMCG index down 1.4 %.

“Because volatility is still high, traders should buy on dips—but keep a tight stop‑loss and limit use of leverage,” market experts advised. They added it’s wise to book partial profits during sharp rallies and set trailing stops to protect gains.

In short, a U.S.‑China investigation eye and rising oil prices have the Mumbai exchanges a bit wary today. Investors are keeping a close eye on support levels and staying cautious with risk‑heavy trades.

Source: ianslive

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in world News on Latest NewsX. Follow us on social media Facebook, Twitter(X), Gettr and subscribe our Youtube Channel.