Reliance Communications’, Anil Ambani’s loan accounts declared as ‘fraudulent’ by Bank of Baroda (Lead)

Bank of Baroda Declares Reliance Communications and Anil Ambani’s Loans as Fraud

In a major development, Bank of Baroda, one of India’s biggest public sector banks, has officially classified the loan accounts of Reliance Communications (RCom) and its former chairman, Anil Ambani, as “fraud.” This move was announced through an official stock exchange filing and marks a new chapter in the ongoing financial troubles surrounding the telecom giant.

This classification applies to loans taken out before RCom started its insolvency process under India’s Insolvency and Bankruptcy Code (IBC) in June 2019. RCom is currently under the supervision of a resolution professional, tasked with managing the company’s recovery plans.

RCom has clarified that these loans were borrowed before the company entered insolvency. It is now working with its creditors to find a resolution, either through a settlement plan or liquidation, as part of the bankruptcy proceedings pending approval from the National Company Law Tribunal (NCLT).

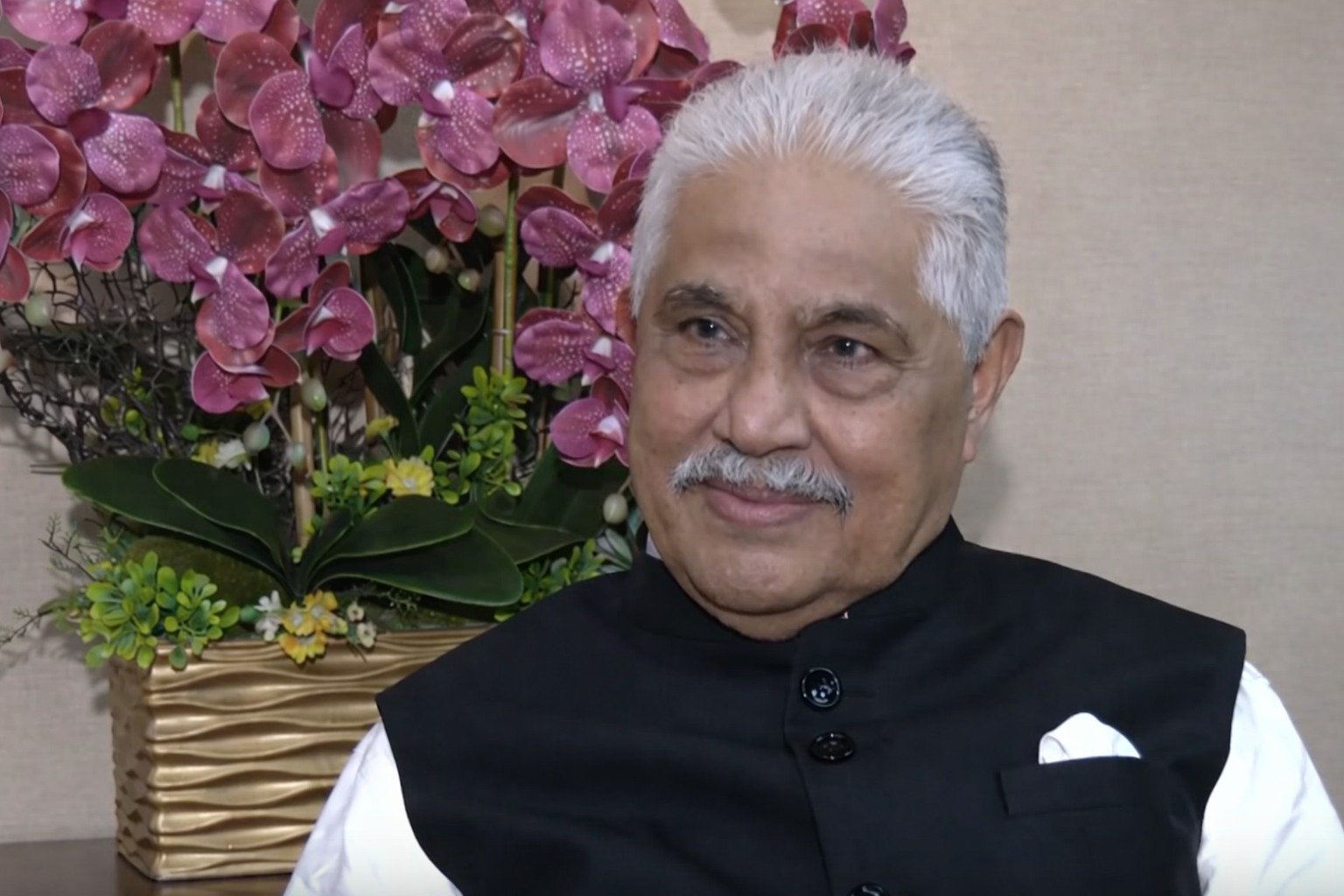

Former Reliance Communications Director Anil Ambani, who resigned from the company’s board in 2019, has responded to the fraud claims. His spokesperson stated that the bank’s action relates to issues that occurred over 12 years ago, back in 2013. The spokesperson emphasized that Ambani was only a Non-Executive Director during his tenure and did not have a role in daily business operations or decision-making.

Currently, RCom is seeking legal advice on the bank’s fraud classification. The company also highlighted that during the insolvency process, it is protected from any legal suits or court proceedings, including judgments or orders against it.

Interestingly, this move coincides with an ongoing investigation by India’s Enforcement Directorate (ED) into alleged loan fraud involving Anil Ambani’s group companies. The ED is looking into loans worth nearly Rs 17,000 crore provided to Reliance Housing Finance, RCom, and Reliance Commercial Finance, and has contacted several banks for details.

Bank of Baroda has assured that it will report the fraud classification to authorities like the Reserve Bank of India (RBI), following mandated guidelines on fraud management in banks and financial institutions.

Earlier, major banks had already flagged RCom’s loans as fraudulent. In June, the State Bank of India (SBI) was the first to do so, followed by Bank of India in August. Both banks cited allegations of fund diversion and violation of loan terms, with Ambani’s name linked to these claims.

As this situation develops, many are watching closely to see how it will affect RCom’s bankruptcy proceedings and what it means for the banking sector’s efforts to handle non-performing assets (NPAs). The case also shines a light on the challenges faced by Indian banks and the ongoing fight against financial fraud in the corporate sector.

Reliance Communications, based in Navi Mumbai, is a well-known telecom company that has been in insolvency since 2019, with its assets managed by appointed resolution professionals. The latest steps by Bank of Baroda add a new layer to the complex financial story involving one of India’s top business figures.