Mumbai, Dec 14 (LatestNewsX) – Analysts warned that foreign institutional investor (FII) selling is likely to ease in the coming days because the economy is performing well, earnings prospects are improving, and mutual‑fund SIP inflows remain healthy.

So far in December, FIIs have divested about ₹15,959 crore of equity on the exchanges. This volume of sales has been far outweighed by domestic institutional investors (DIIs) who bought ₹39,965 crore during the same period, according to market watchers.

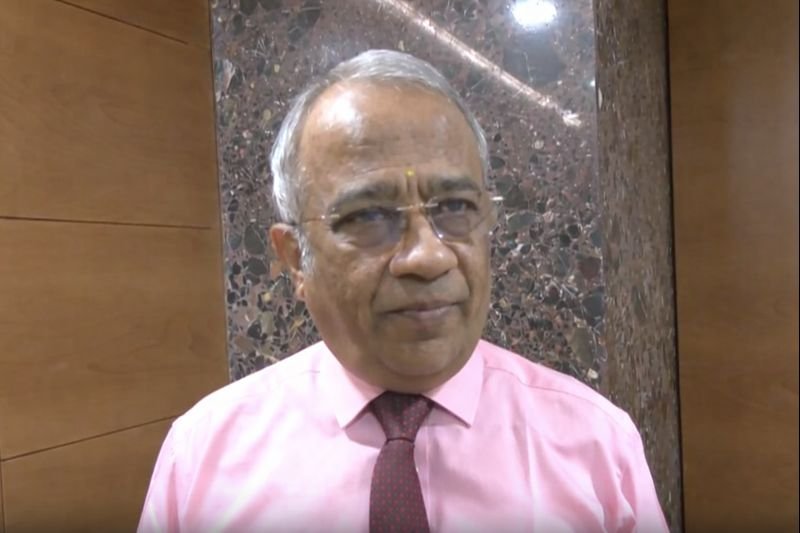

Dr VK Vijayakumar, chief investment strategist at Geojit Investments, said: “Sustained selling in India when the prospects for growth and earnings look bright is not a sustainable policy.”

Retail investors have helped keep the market buoyant, with SIP inflows exceeding ₹29,000 crore for each of the last three months. AMFI data confirmed that November inflows stayed steady at ₹29,445 crore. This steady cash flow has allowed DIIs to absorb the persistent FII selling, Vijayakumar explained.

He went on to add: “FIIs have been sustained sellers in December, so far, selling on all days. It would be difficult for the FIIs to sell continuously and maintain a high short position in the market in the context of healthy SIP inflows, particularly when the economy is doing well and the prospects for earnings growth are improving.”

Analysts note that temporary drag factors include rupee depreciation, ongoing FII selling, a delay in finalising the US‑India trade deal, and current AI‑related trade issues. In November, both FIIs and DIIs ended up as net buyers of Indian equities, with $40 million and $8.7 billion respectively.

Over the last twelve months, primary markets drew FII net inflows of ₹823 billion ($9.5 billion), while secondary markets saw outflows of ₹2,144 billion ($24.5 billion), per a Reuters note by JM Financial.

India’s weight in the MSCI Emerging Markets Index rose to 15.8 % in November from 15.2 % in October, and later reached 19.9 %.

According to analysts, earnings growth will be the decisive driver of market direction, and outlooks seem promising for FY27.

— LatestNewsX

na/

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in world News on Latest NewsX. Follow us on social media Facebook, Twitter(X), Gettr and subscribe our Youtube Channel.