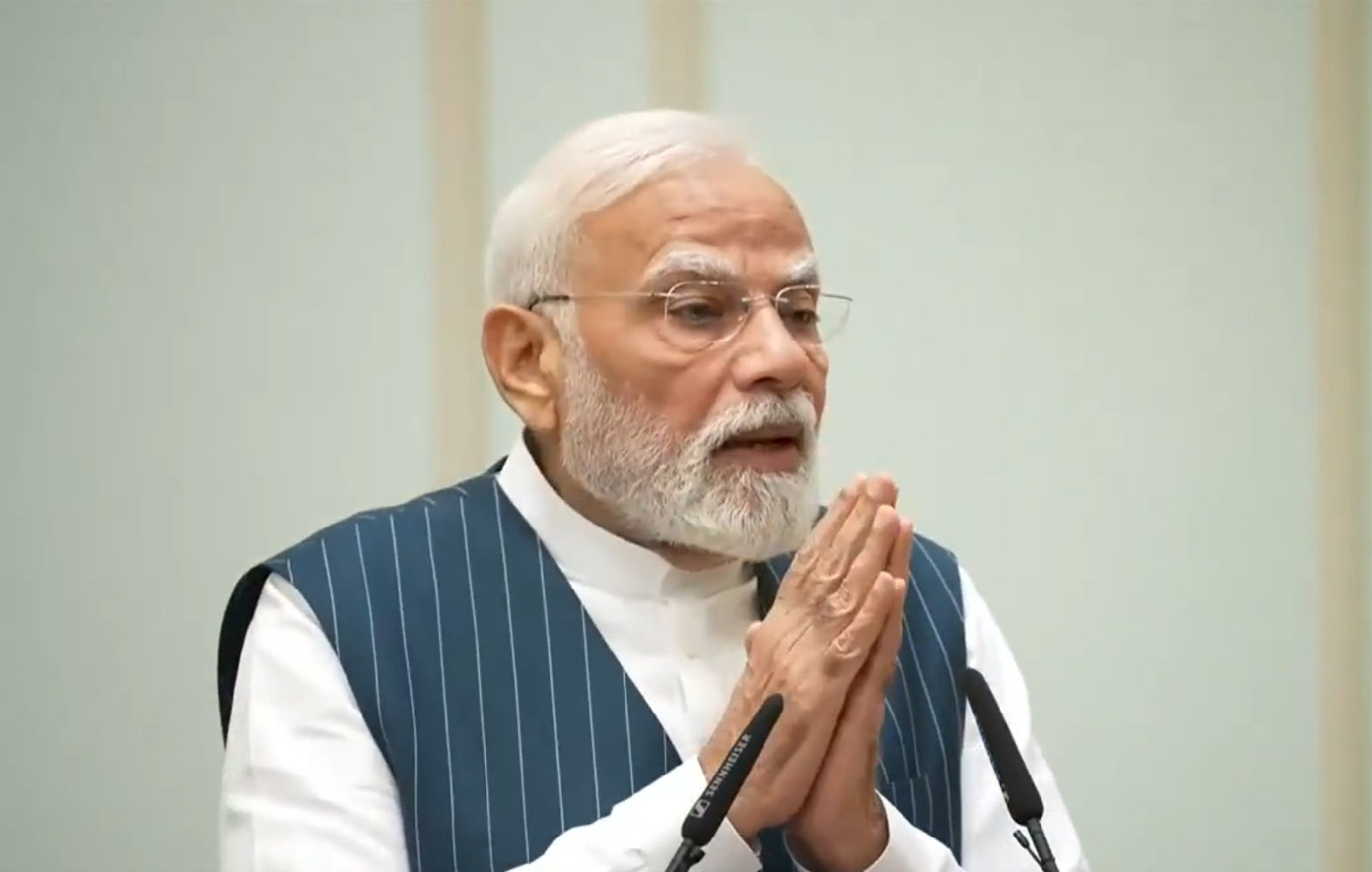

India’s new GST reforms aim to boost the economy and make everyday life easier for the people. Prime Minister Narendra Modi announced that these changes are a “double dose of support and growth” to help India move forward in the 21st century.

The latest GST updates will make life better for Indian citizens by lowering prices on many household items and increasing overall growth. Easier business processes will attract more investments and create more jobs across the country.

In his speech, PM Modi also took a swipe at past governments, saying they had heavily taxed everyday items like kitchen essentials, farming equipment, and medicines. Now, the government is reducing taxes on many items to give relief to the public and support industries.

One big change is the simplified GST structure, which will start on September 22. The new system has only two main tax slabs — 5% and 18% — replacing the older 12% and 28%, making it easier for businesses and consumers to understand and comply.

There is also a high 40% tax on luxury and ‘sin’ goods like tobacco, pan masala, soft drinks, luxury cars, yachts, and private jets. This move aims to bring fairness and balance tax revenue.

Other benefits include faster refunds, simpler registration and return processes, and reduced compliance costs — especially for small businesses, startups, and micro, small, and medium enterprises (MSMEs).

A look at the sector-wise impact shows that these reforms will make many goods cheaper, boost demand, and help drive economic growth. For households, this means savings on everyday essentials. For example, the GST on air conditioners, dishwashers, TVs (LCD and LED) has dropped from 28% to 18%, making gadgets more affordable and supporting India’s electronics manufacturing.

Many daily household products like soaps, shampoos, toothbrushes, toothpaste, and bicycles now face just a 5% GST. Packaged snack foods, chocolates, sauces, pasta, and preserved meats also get a GST cut from 12% or 18% to 5%, reducing costs.

The construction and real estate sectors will benefit too. GST on cement has fallen from 28% to 18%, and on marble and granite from 12% to just 5%. This will lower home and infrastructure costs, encouraging new housing projects and creating jobs in construction.

Auto manufacturers will also gain. GST on small cars, two-wheelers up to 350cc, buses, trucks, and three-wheelers has been reduced from 28% to 18%. This move will lower vehicle prices and boost India’s auto industry for exports.

Farmers will see relief as well. GST on farm machinery dropped from 12% to 5%, helping small farmers cut costs. Items like bio-pesticides and fertilizers now have lower taxes, encouraging sustainable farming and boosting domestic production to reduce dependence on imports.

In the services sector, cheaper GST on hotel stays (up to Rs 7,500 per day), gyms, salons, and yoga will make wellness and leisure more affordable. For example, GST on hotel stays has been cut from 12% to 5%. This is expected to promote tourism and the hospitality industry.

The textile sector will also benefit as the GST on manmade fibers drops from 18% to 5%, helping export competitiveness. Handicrafts and traditional arts will get support through lower GST, helping artisans and preserving India’s rich cultural heritage.

Education costs are decreasing too. Items like school exercise books, erasers, pencils, crayons, and sharpeners now attract zero GST. This will ease the financial burden on families and promote better access to quality education.

Medical goods and medicines also see big relief. The GST on 33 life-saving drugs and diagnostic kits is now zero. Other medicines, including Ayurveda, Unani, and Homoeopathy treatments, are now taxed at just 5%, making healthcare more accessible and encouraging local manufacturing.

Lastly, health and life insurance premiums are now exempt from GST, making financial protection plans more affordable for all, supporting India’s goal of “Insurance for All” by 2047.

These GST reforms are set to make common goods cheaper, improve business ease, create jobs, and support India’s economic growth — a clear win for the country’s future.