In a major move applauded by international business leaders, the recent overhaul of India’s tax structure is being hailed as a game-changer for the economy and consumers alike.

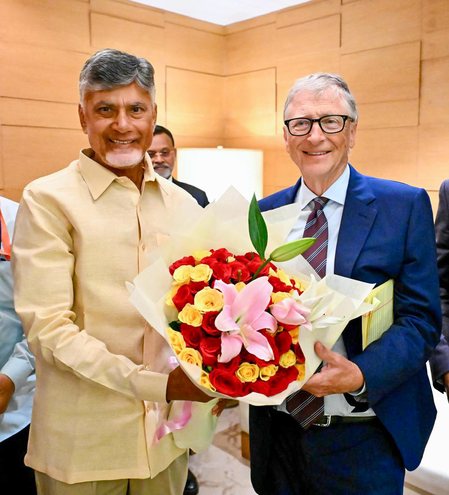

The US-India Business Council (USIBC), a top body representing American companies, has publicly praised the government’s decision to rationalize the GST tax slabs. The council stated that this reform is a crucial step towards creating a simpler, more transparent, and efficient tax system for India.

“This sends a strong signal to global investors about India’s commitment to growth and improving the ease of doing business,” the USIBC said in a statement on social media platform X. They added that such forward-looking reforms significantly improve the business climate in the country.

The council extended its appreciation to Prime Minister Narendra Modi, the GST Council, and the Finance Ministry for the recent changes. They specifically commended the government’s efforts to boost consumption by reducing GST rates on essential items. “The reduction of GST on products across sectors—including food, healthcare, life-saving drugs, and electronics—will improve consumer access and affordability. This will not only benefit businesses but also strengthen India’s growth story,” the statement read.

So, what does this mean for you?

Starting September 22nd, the current complex 4-tier tax structure will be simplified into a dual-slab system. Most goods will now fall under the 5% or 18% GST brackets, with a top slab of 40% reserved for luxury items and certain “sin goods” like intoxicants.

This simplification is expected to put more money back in the pockets of consumers. According to a Crisil Intelligence Report, the revenue of Indian companies is likely to grow by 6-7% this financial year because of these GST cuts. Since consumer spending makes up a significant portion of corporate revenue, this move is expected to give a direct boost to consumption.

The timing of these tax cuts couldn’t be better. They come amid global economic uncertainties and just in time for India’s busy festival and wedding season—a period when household spending traditionally sees a massive annual peak.