In a big move for India’s economy, the government has now simplified the Goods and Services Tax (GST) system. NSE Managing Director and CEO Ashishkumar Chauhan praised this decision, saying that lower tax rates will put more money into people’s hands. When people have more money to spend, it boosts economic growth and creates a positive cycle for the country.

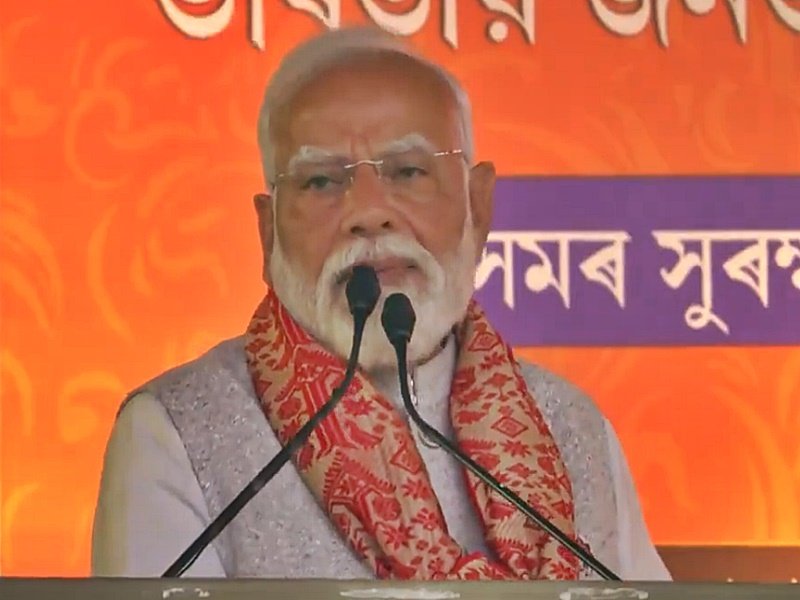

Chauhan also congratulated Prime Minister Narendra Modi and Finance Minister Nirmala Sitharaman for their “historic” step to cut GST slabs from four to just two. This change makes the tax system much easier to understand and follow, which can lead to better compliance and less tax evasion.

He explained that reasonable taxes not only help people and businesses but also encourage more transparency. Chauhan believes this move will help India grow at over 8% GDP in the coming years. He mentioned that the original GST roll-out in 2017 was already a milestone for India’s economy, and this latest reduction will further strengthen the country’s growth story.

The GST Council, led by Finance Minister Sitharaman, announced that the 12% and 28% tax rates would be phased out, leaving only the 5% and 18% slabs. This new GST structure will officially start from September 22.

As part of the changes, many everyday items will become cheaper. For example, personal care products like hair oil, shampoo, toothpaste, and dental floss saw their GST drop from 18% to just 5%. Packaged snacks such as namkeens, bhujia, and mixtures are also moving from 12% to 5%.

Overall, this move aims to make the GST system simpler, boost compliance, reduce tax evasion, and support India’s economic growth. It’s a positive step towards building a stronger and more vibrant economy for all Indians.