Govt asks businesses to display GST cut benefits, FMCG companies call for strict price monitoring

Big GST Overhaul: How the New Tax Cuts Will Make Everyday Items Cheaper

The Indian government is rolling out a major update to the Goods and Services Tax (GST) system, and it’s all about helping you save money on your shopping. Starting September 22, businesses must show clear price lists comparing old and new prices for everything from cars to household gadgets. This way, you can easily spot the savings from the GST rate cuts.

These updated price lists will go live on the official GST website, making it simple for consumers to check the benefits. The new GST regime simplifies things with just two main slabs: 5% and 18%, plus a 40% rate for luxury items and sin goods like tobacco or high-end cars. Retailers and car dealerships have to display both pre-GST and post-GST prices right in their stores for full transparency.

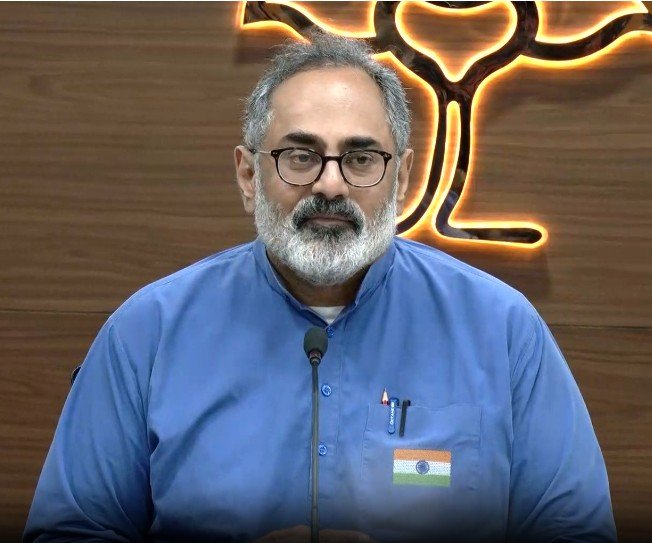

To make sure everything runs smoothly, the Central Board of Indirect Taxes and Customs (CBIC) recently met with industry groups and key ministries—like heavy industry, consumer durables, agriculture, and pharma. Everyone agreed to pass on the tax cut benefits directly to buyers. For instance, consumer durables such as washing machines and fridges could drop by at least 10%, while car prices might fall 12-15%.

FMCG companies, which handle fast-moving items like soaps and snacks, are pushing for strict checks to prevent any company from pocketing the savings. They’ve asked the CBIC chief to issue clear orders for all firms to update stickers, invoices, and pricing right away under the new GST rates.

The best part? These changes could tame inflation and boost your wallet. Food inflation might ease by 25-35 basis points over the next six months, thanks to cheaper prepared meals, cooking oils, bread, noodles, butter, and vanaspati. Core inflation, which covers essentials like soaps, toothpaste, household appliances, and medicines, could drop 30-40 basis points.

According to Bank of Baroda’s research, India’s GST reforms might slash overall headline inflation by up to 75 basis points and free up as much as Rs 1 lakh crore in extra spending power for consumers. So, get ready for some real relief on your next grocery run or big purchase— the GST rate reforms are here to make life a bit more affordable.

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in world News on Latest NewsX. Follow us on social media Facebook, Twitter(X), Gettr and subscribe our Youtube Channel.