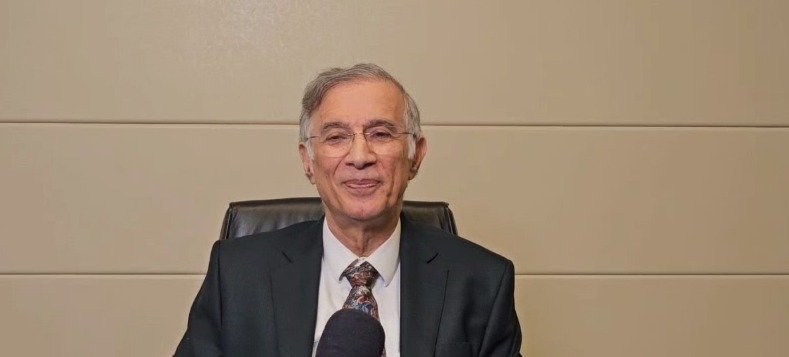

Mumbai: The recent overhaul of India’s Goods and Services Tax (GST 2.0) has garnered praise from industry leaders, with Hiranandani Group co-founder Dr. Niranjan Hiranandani calling it a “revolutionary” move. He described the new GST reforms as a bold and transformative step by the Narendra Modi government that could boost the economy.

In an interview with , Hiranandani said, “During his Independence Day speech, PM Modi promised something revolutionary before Diwali, and he has delivered. This isn’t just a minor change—it’s a true revolution in our tax system.”

The updated GST structure introduces some significant changes. Key highlights include the removal of multiple tax slabs, now streamlined into just two main rates: 5% and 18%. Additionally, a new ‘sin tax’ of up to 40% has been introduced on goods harmful to health like tobacco and soft drinks. Meanwhile, the GST on essential construction materials has been reduced to 18%.

Hiranandani explained that these changes strike a good balance between increasing government revenue and encouraging growth. “Many people see these as just small modifications, but they are much more. The government is working to generate revenue for infrastructure and technology projects while making everyday products more affordable,” he said.

One of the most significant benefits he pointed out is relief for common consumers. For example, items that used to be taxed at 12%—such as essential groceries—have now been reduced to just 5%. At the same time, harmful goods like cigarettes and sugary drinks face higher taxes, discouraging their use.

Hiranandani also called out the important decision to remove GST from medicines. “That’s a much-needed move. Healthcare costs are high, especially for families in the middle and lower-income groups. Removing GST on medicines will help many people,” he emphasized.

He appreciated the government’s approach to taxing sin products at higher rates, saying, “The 40% tax on harmful items is a good step because it encourages people to buy less of these products, which can improve public health.”

Starting from September 22, many everyday products—such as groceries, footwear, textiles, fertilizers, and even renewable energy equipment—will become more affordable. Goods previously taxed at higher rates are now falling into the lower slabs, providing relief to consumers and potentially giving the economy a much-needed boost.

Overall, the GST 2.0 reforms are seen as a big step forward in making India’s tax system simpler and more shopper-friendly, while also focusing on health and infrastructure growth.